Understand a venture capitalists life. One major disadvantage of venture capital is that when you take on a VC firm youre trading equity for that funding.

The Dark Side Of Venture Capital Five Things Startups Need To Know Techrepublic

Up to 24 cash back Venture Capital Fills a Void Contrary to popular perception venture capital plays only a minor role in funding basic innovation.

. Large returns in a short period of time c. Based on experience expertise and past performance of the VC. They are targeting a 100X return pretty much for every company.

Dealing with Venture Capitalists March 2 2010 18 min read A critical step in the creation of a new venture is raising the capital to bring the new. Capacity of the business partners. Venture capitalists invested more than 10 billion in 1997 but.

1 The cost of venture capital is high. You need to make sure each person is highly qualified and. 2 Venture Capitalists are not patient investors.

Here are the six things VCs will want to know before they invest in your company. Its time to embrace more education and industry best practices so that we can. Stable operating history b.

The best approach is to be truthful and authentic. The name and reputation of a VC often reflect on. Contrary to popular perception venture capital plays only a minor role in funding basic innovation.

Venture Capitalists have different reputations which are ie. Some disadvantages of venture capital are. VCs want you to demonstrate that theres.

Basics of Entrepreneurship. Venture capitalists VCs are known for making large bets in new start-up companies hoping to hit a home-run on a future billion-dollar company. A venture capital firm will expect to at least make the average return but may have higher.

Large returns in a short period of time. Loss of Control and Ownership Status. According to the National Bureau of Economic Research the average return is 25 percent.

Venture capitalists invested more. Performance must meet or exceed. So seed fund investors will do anywhere from 20 to 50 to 60 investments depending on their fund size.

Although it is less in the spotlight than Venture Capital conceived by independent private funds it has grown significantly in the past ten years and prospects of growth remain. Theyre not interested in linear growth and will pressure you to manage the business to grow sales at. Venture Capital Fills a Void.

Venture capital remains a Wild West where rule-breaking is a foundational principle. Of surprise to many businesses applying for venture capital is the fact the venture capitalists will value their business much lower than the business believes is accurate. Which best states the expectations of venture capitalists.

Venture Capitalists expect 10 times their returns in less than seven years. You cant just fill startup roles for the sake of creating a team and launching. Hes on as many as ten boards that meet at least quarterly and sometimes once a month.

He has to raise money to invest and keep about. Which of the following best states the expectations of venture capitalists.

Venture Capital Activity Exceeds Expectations In Q1 2021 Ey Us

Venture Capital Features Types Funding Process Examples Etc

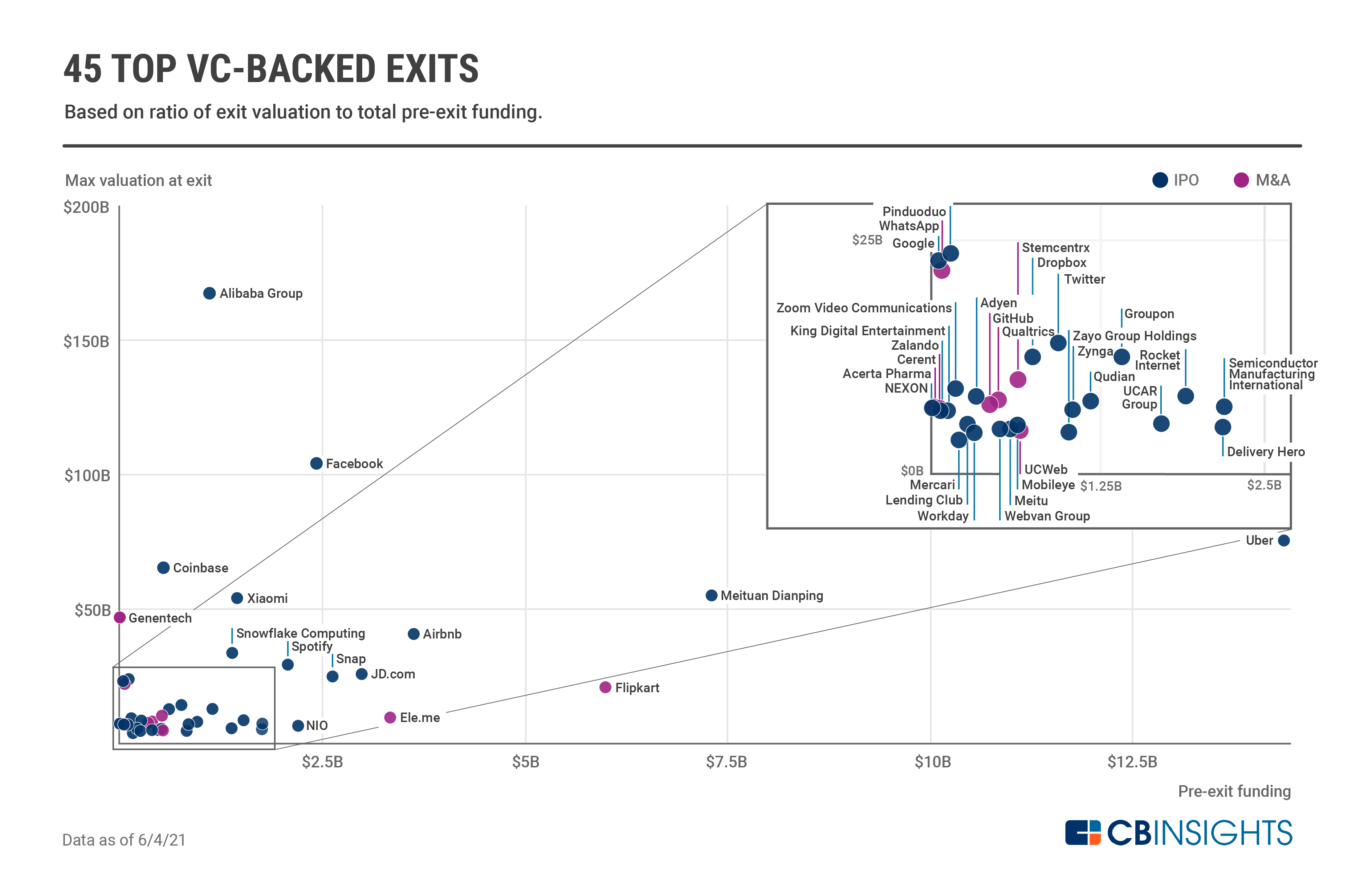

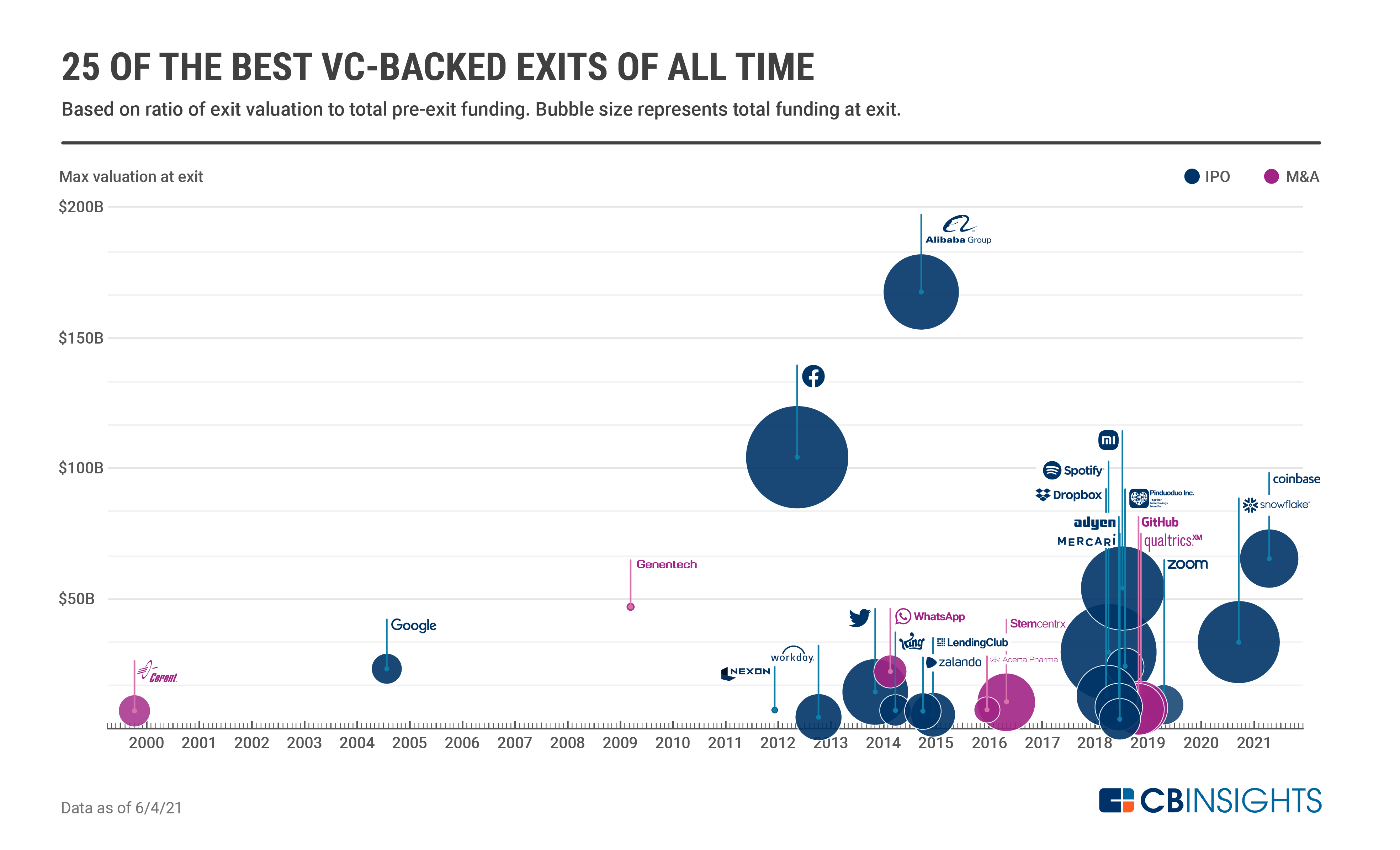

The 45 Best Vc Investments Of All Time What To Learn From Them Cb Insights Research

The 45 Best Vc Investments Of All Time What To Learn From Them Cb Insights Research

0 Comments